Worthwhile

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

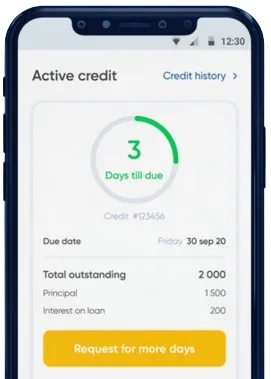

Apply conveniently via our app with a straightforward form.

Wait briefly for our decision, typically 15 minutes.

Secure your funds, generally processed in just one minute.

Apply conveniently via our app with a straightforward form.

Download loan app

Payday loans have become a popular financial tool for many people in South Africa. These loans offer a quick and easy way to access cash when you need it most. One of the main benefits of payday loans online is the convenience they offer. You can apply for a loan from the comfort of your own home, without having to visit a physical store or bank.

Another key benefit of payday loans is the speed at which funds are made available. In most cases, you can receive approval and have the money in your account within the same day. This quick turnaround time makes payday loans a great option for those who need money urgently.

Payday loans are useful for a variety of reasons. They can help you cover unexpected expenses, such as medical bills or car repairs. They can also provide a temporary solution for those facing financial difficulties, such as being unable to pay bills on time.

Additionally, payday loans online are a good option for individuals with poor credit history. Traditional lenders may not approve a loan for those with bad credit, but payday lenders are often more flexible in their approval criteria. This accessibility makes payday loans a valuable resource for those who may not qualify for other types of loans.

Overall, payday loans online in South Africa offer a practical solution for those in need of quick cash. Whether you are facing an emergency or simply need a short-term financial boost, payday loans can provide the assistance you need.

It is important to be aware of the costs associated with payday loans. While these loans offer quick and easy access to cash, they typically come with high interest rates. Before taking out a payday loan, make sure you understand the terms and conditions, including the repayment schedule and any additional fees.

Failure to repay a payday loan on time can result in additional charges and potentially damage your credit score. It is essential to borrow responsibly and only take out a loan if you are confident in your ability to repay it on time.

Payday loans online in South Africa can be a helpful financial tool when used responsibly. The convenience, speed, and accessibility of these loans make them a valuable resource for individuals facing unexpected expenses or financial difficulties. However, it is crucial to understand the costs associated with payday loans and borrow responsibly to ensure a positive borrowing experience.

In South Africa, payday loans online are short-term loans that are typically repaid on the borrower's next payday. Borrowers can apply for these loans through online platforms and receive funds directly into their bank accounts.

To qualify for a payday loan online in South Africa, borrowers usually need to be over 18 years old, have a regular income, and provide proof of identity and bank account details.

The maximum loan amount that can be borrowed with a payday loan online in South Africa varies between lenders but is usually limited to a few thousand rand. Lenders assess the borrower's income and creditworthiness to determine the loan amount.

Many online payday loan lenders in South Africa offer quick approval and disbursement of funds, often within the same day of the application being approved. The speed of fund transfer may vary depending on the lender and the borrower's bank.

Payday loans online in South Africa typically have higher interest rates and fees compared to traditional bank loans. It is essential for borrowers to carefully review and understand the terms and conditions, including the total cost of borrowing, before agreeing to a payday loan.

Some payday loan lenders in South Africa may offer loan extensions or rollovers, but this usually comes with additional fees and interest charges. It is crucial for borrowers to communicate with their lender if they are having trouble repaying the loan on time to explore options.